What Are Some Real-Life Coopetition Examples in India?

If you’re intrigued by how Indian businesses navigate the fine line between competition and cooperation to thrive, you’re in for a treat. Today, we’ll delve into the captivating concept of coopetition—a strategy that allows companies to collaborate while still pursuing market dominance.

What if the fiercest competitors in your industry decided to join forces instead of battling it out? Can collaboration between rivals actually lead to greater success?

In India’s fast-paced business landscape, how do companies like Amazon and Flipkart manage their rivalry while partnering with logistics firms? What about the automotive giants who come together to develop electric vehicle technologies?

By exploring these real-life Coopetition examples, you’ll uncover how strategic partnerships and joint ventures are transforming the Indian market. Are you ready to uncover valuable insights that could reshape your own growth strategies? Let’s dive in!

Understanding Coopetition in the Indian Business Landscape

Imagine a scenario where your fiercest competitor becomes your ally for a shared goal. That’s the essence of coopetition—a blend of cooperation and competition. In India, this strategy thrives due to the country’s unique market dynamics: rapid economic growth, a vast consumer base, and intense rivalry among businesses.

Companies here recognize that collaborating on specific projects—like sharing resources or co-developing technology—can unlock benefits unattainable alone, all while maintaining their competitive edge elsewhere.

India’s interconnected economy amplifies the need for such alliances. Whether it’s pooling capital for massive infrastructure projects or combining expertise to reach untapped markets, coopetition in India offers a practical solution to challenges like high costs and technological advancements.

Game theory underpins this approach, suggesting that working together can expand the market for everyone, rather than leaving one player to claim it all. Ready to see this in action? Let’s explore some compelling examples.

Coopetition in India’s Telecommunications Sector

The Indian telecom industry is a hotbed of competition, with giants like Reliance Jio, Bharti Airtel, and Vodafone Idea dominating the scene.

With over 1.17 billion subscribers as of 2023 (source: Telecom Regulatory Authority of India), the stakes are high. Yet, the enormous costs of building networks—especially for 5G—push these rivals toward collaboration.

-

Infrastructure Sharing

One practical example is telecom tower sharing. Companies pool resources to reduce expenses, allowing them to focus on competing through better pricing and service quality. A 2022 report by Deloitte noted that India has over 7,00,000 telecom towers, with many co-owned by competitors, cutting costs by up to 30%.

-

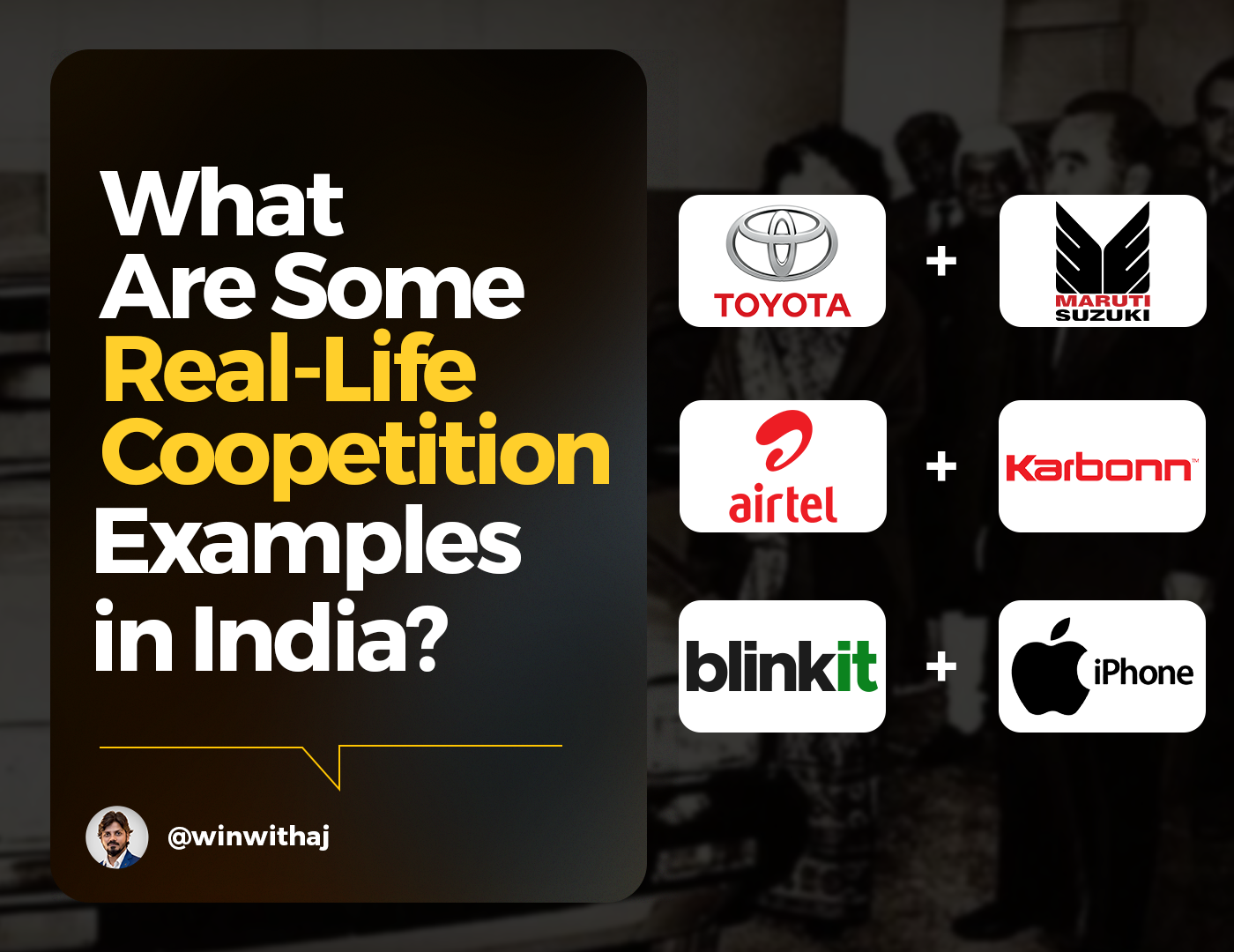

Airtel and Karbonn Partnership (2017)

Facing Reliance Jio’s disruptive JioPhone launch, Bharti Airtel teamed up with Karbonn Mobiles to offer affordable 4G smartphones. Airtel bundled its data plans with Karbonn’s handsets, sold via Amazon India, targeting feature phone users.

This move helped Airtel retain customers while Karbonn expanded its reach. Though initial sales soared, some users criticized the cashback terms, highlighting the challenges of aligning partner goals.

Looking ahead, the 5G rollout could deepen coopetition. Research from GSMA predicts India’s 5G investment could hit $70 billion by 2030, a burden too heavy for one player. Sharing spectrum or infrastructure might become the norm, letting rivals compete on customer experience instead.

As telecom expert R.K. Arnold once said, “Collaboration in infrastructure is the backbone of competition in services.”

Coopetition in India’s E-commerce Sector

India’s e-commerce market, projected to reach $200 billion by 2027 (source: IBEF), is a battleground for giants like Flipkart and Amazon, alongside quick commerce players like Blinkit. Yet, beneath the rivalry lies a clever collaboration.

-

Marketplaces and Offline Retailers

Amazon and Flipkart host small brick-and-mortar stores on their platforms, giving these retailers access to millions of online shoppers. In return, the platforms broaden their product range. It’s a win-win: offline stores gain visibility, while e-commerce giants strengthen their offerings—yet they still compete for the same customers.

-

Blinkit and Apple Reseller

In 2023, quick commerce platform Blinkit partnered with Unicorn Infosolutions, an Apple Premium Reseller, to deliver iPhones within hours. This alliance boosted Blinkit’s premium offerings and gave Unicorn a new sales channel, all while both compete in the broader electronics market.

Quick commerce and traditional e-commerce might soon collaborate further. Sharing logistics hubs could cut delivery costs, allowing them to focus on speed versus variety. However, competition remains fierce, with price wars and exclusive deals driving the fight for dominance.

Coopetition in India’s Automotive Sector

India’s automotive industry, the fourth-largest globally, produced 25.9 million vehicles in 2022-23 (source: SIAM). With players like Maruti Suzuki, Toyota, and Tata Motors, it’s a competitive space ripe for coopetition, especially as electric vehicles (EVs) gain momentum.

-

Toyota and Suzuki Alliance

This partnership is a standout. Toyota and Suzuki share vehicles (e.g., Suzuki’s Baleno rebadged as Toyota’s Glanza), co-develop EVs, and exchange hybrid technology. Toyota’s stake in Suzuki strengthens their bond.

In India, this collaboration has boosted Toyota’s sales by 40% through Suzuki models (source: Economic Times, 2023), while Suzuki taps Toyota’s electrification expertise. They compete on branding and networks but cooperate to cut costs and innovate.

-

Historical Maruti-Suzuki Venture

Back in 1982, the Indian government partnered with Suzuki to form Maruti Udyog. This alliance brought affordable cars to millions, revolutionizing the market. Today, Maruti Suzuki holds a 41% share (source: Autocar India, 2024).

-

Component Suppliers and OEMs

Auto parts makers collaborate with manufacturers like Mahindra to meet quality standards, yet compete for contracts. India’s auto component exports hit $21 billion in 2023 (source: ACMA), reflecting this dual dynamic.

The EV boom could spark more alliances. With EV sales expected to reach 10 million units by 2030 (source: NITI Aayog), Indian firms might partner with global leaders to accelerate growth, all while racing to lead the market.

Emerging Areas of Coopetition in India

Coopetition isn’t limited to these sectors. In technology, Indian IT firms might team up with global players for projects while battling for talent. In finance, banks like HDFC collaborate with fintechs on digital platforms, yet compete for customers.

The Airtel-Bajaj Finance tie-up to build a financial services ecosystem is a prime example. Even in pharmaceuticals, rivals might share R&D costs for drugs, then compete on sales.

A unique trend is data cooperatives—farmers pooling agricultural data to secure better loans, blending collaboration with individual goals. As Peter Drucker, management guru, noted, “The best way to predict the future is to create it.” These emerging alliances show how Indian businesses are doing just that.

Why Coopetition Works in India: Drivers & Outcomes

What pushes Indian companies into coopetition? Here are the key drivers:

- Market Access: Partnerships open new regions or demographics.

- Cost Sharing: Splitting infrastructure or R&D expenses reduces risk.

- Innovation: Combining strengths speeds up product development.

- Competitor Response: Alliances counter disruptive players.

Outcomes vary. Successful coopetition boosts market share, cuts costs, and sparks creativity—think Toyota-Suzuki’s hybrid advancements. But risks like trust issues or regulatory hurdles (e.g., Competition Commission of India oversight) can derail efforts. A 2021 McKinsey study found 60% of strategic alliances succeed when trust and clear goals are prioritized.

Challenges and Success Factors

Coopetition isn’t easy. India’s complex regulations, cultural differences in global partnerships, and infrastructure gaps pose hurdles. Building trust between rivals is tough—imagine sharing secrets with a competitor! Yet, solutions exist:

- Define clear objectives.

- Balance power and benefits.

- Communicate openly.

- Draft solid contracts.

A “coopetition mindset”—seeing rivals as potential partners—can turn challenges into opportunities.

Your Takeaway on Coopetition in India

Coopetition is reshaping India’s business landscape, from telecom towers to EV batteries. It’s a strategy that blends rivalry with collaboration, offering you a blueprint for growth in a competitive world. As India’s economy evolves, mastering this balance could be your key to staying ahead. What do you think—could coopetition work for your goals? Share your thoughts below and join the conversation on the Win With AJ blog!

Are you a business owner or entrepreneur and worried about your competitors? Well, it’s common, Coopetition is not recommended for every business. Something that might work for a specific business might not work for others. If you are unsure how to start, I can help. Book a discovery call with me today!

FAQs

What is coopetition in simple terms?

It’s when companies compete and cooperate at the same time, like sharing resources but rivaling for customers.

Why is coopetition popular in India?

India’s fast-growing, diverse market encourages firms to collaborate on big challenges while competing for market share.

Can small businesses use coopetition?

Yes! Partnering with a rival on logistics or marketing can help you scale without losing your edge.