7 Online Accounting Software for Small Business in India

In today’s digital landscape, how confident are you in managing your small business’s finances? With various online accounting software available, are you leveraging their full potential?

Imagine having the ability to monitor your company’s financial health from anywhere, saving valuable time and money while simplifying accounting processes to focus on growth.

The digital transformation of Indian businesses has significantly impacted financial management for small enterprises. A 2024 KPMG report indicates that 78% of Indian SMEs have adopted digital accounting, reflecting a 45% rise since before the pandemic.

As Deepak Ghaisas, former CEO of i-flex Solutions, states, “The future of accounting is more than just number crunching; it’s about intelligent data interpretation and timely decision-making.”

Efficient financial management through secure online accounting software is essential for small businesses in India. These tools have become crucial assets, improving quality, reducing costs, and speeding up operations.

This article highlights 7 top online accounting software options for small businesses in India, empowering you to choose the best fit for your financial management needs. Are you ready to elevate your business?

Why is Online Accounting Software Essential for Small Businesses?

Let’s first take a look at the reasons why online accounting software as a concept is very important for small businesses in India before we Proceed to a detailed analysis of the software options.

-

Time-saving

By means of automating the tasks that are usually repeated, the employees of the concerns can be freed up to concentrate on the core business.

-

Accuracy

The law requires providing error-free information. But the human factor can sometimes lead to mistakes. Moreover, automation can sufficiently reduce errors in financial calculations and reporting.

-

Compliance

Indian tax laws and regulations are strictly adhered to by the application of reliable software.

-

Real-time insights

Business managers have the opportunity to get a clear picture of the company’s financial position because of the updated finances daily.

-

Cost-effective

Employing a web-based accounting system can save businesses a lot of money, and in many cases, it is even more affordable than the option of hiring full-time accountants.

-

Accessibility

A company is given a chance to get into financial data from any place and at any time by means of this very program.

Top 7 Online Accounting Software Options for Small Businesses in India

1. Tally Prime

Core Features

- Native Indian tax compliance

- Comprehensive inventory management

- Multi-currency support

- Remote access capabilities

- Robust security protocols

Pricing Structure

- Silver Edition: ₹18,000 (one-time)

- Gold Edition: ₹36,000 (one-time)

User Experience

Based on a 2024 Software Suggest survey of 1,200 Indian SMEs, Tally Prime maintains a 92% satisfaction rate among users, particularly praised for its GST compliance features.

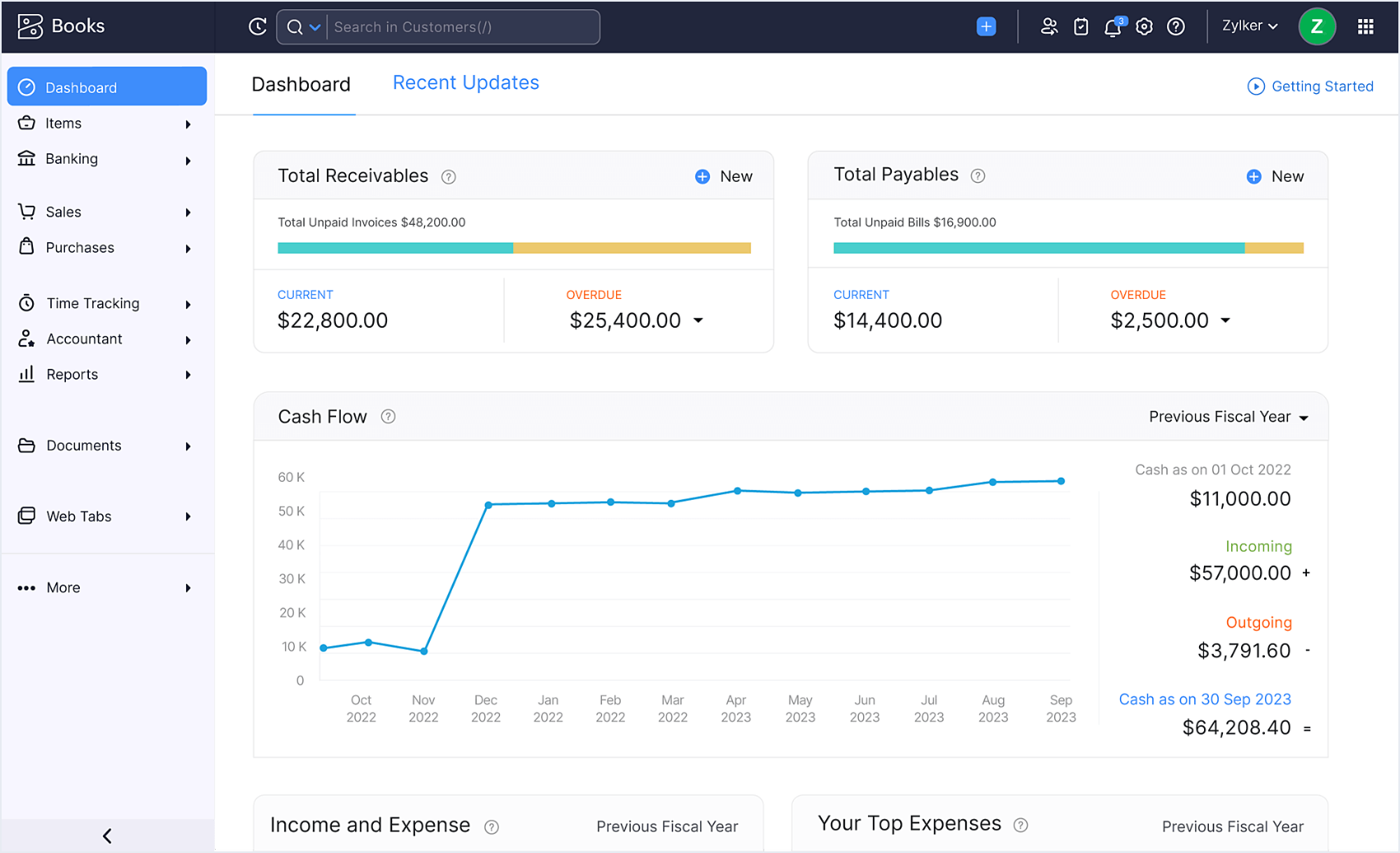

2. Zoho Books

Core Features

- End-to-end accounting automation

- Client Portal

- Banking integration

- Advanced Reporting

- Mobile application

Pricing Structure

- Standard: ₹2,999/month

- Professional: ₹5,999/month

- Premium: ₹7,999/month

Market Position

Zoho Books has captured 23% of the Indian SME accounting software market, according to a 2024 Gartner report.

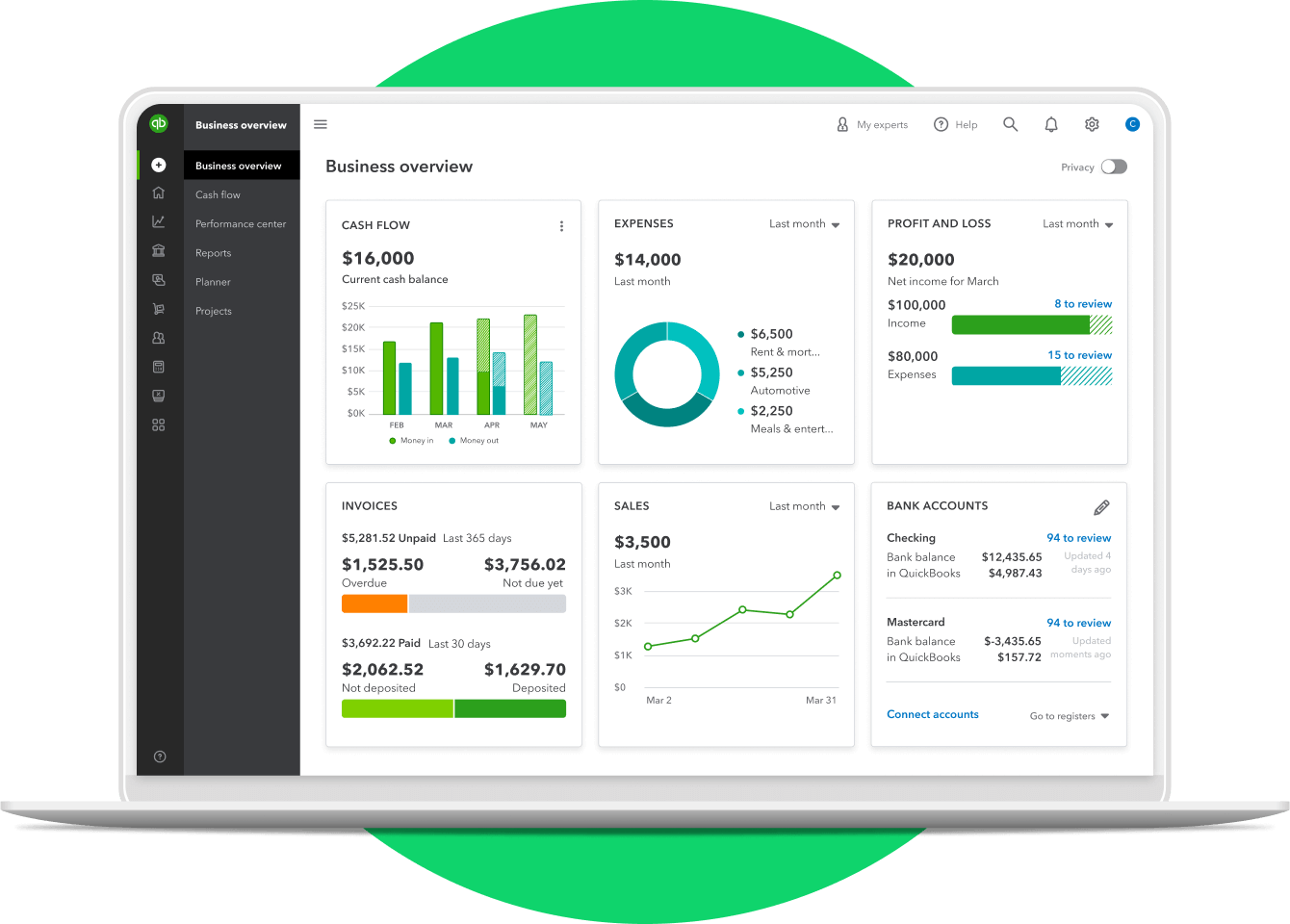

3. QuickBooks Online

Core Features

- Intuitive interface

- Comprehensive reporting

- Expense tracking

- Multi-user access

- Bank reconciliation

Pricing Structure

- Simple Start: ₹4,999/month

- Essentials: ₹7,999/month

- Plus: ₹11,999/month

Industry Recognition

Received the 2024 Global Banking & Finance Review Award for “Best SME Accounting Software in India”

4. Clear (Formerly ClearTax)

Core Features

- GST-focused solution

- E-way bill generation

- TDS compliance

- Financial reporting

- Cloud backup

Pricing Structure

- Basic: ₹999/month

- Pro: ₹1,999/month

- Enterprise: Custom pricing

Market Impact

Processes over 10 million GST returns annually, serving 5% of India’s registered GST taxpayers.

5. Busy Accounting Software

Core Features

- Inventory management

- GST billing

- Financial statements

- Multi-branch support

- Data security

Pricing Structure

- Standard: ₹10,800 (one-time)

- Enterprise: ₹18,000 (one-time)

User Base

Currently serves over 500,000 Indian businesses, with a strong presence in tier 2 and 3 cities.

6. SAP Business One Starter Package

Core Features

- Financial management

- Sales and customer management

- Purchasing and inventory control

- Analytics and reporting

- Mobile accessibility

Pricing Structure

- Starter: ₹3,999/user/month

- Professional: Custom pricing

Enterprise Integration

Particularly suitable for businesses planning to scale, with 89% of users reporting improved operational efficiency.

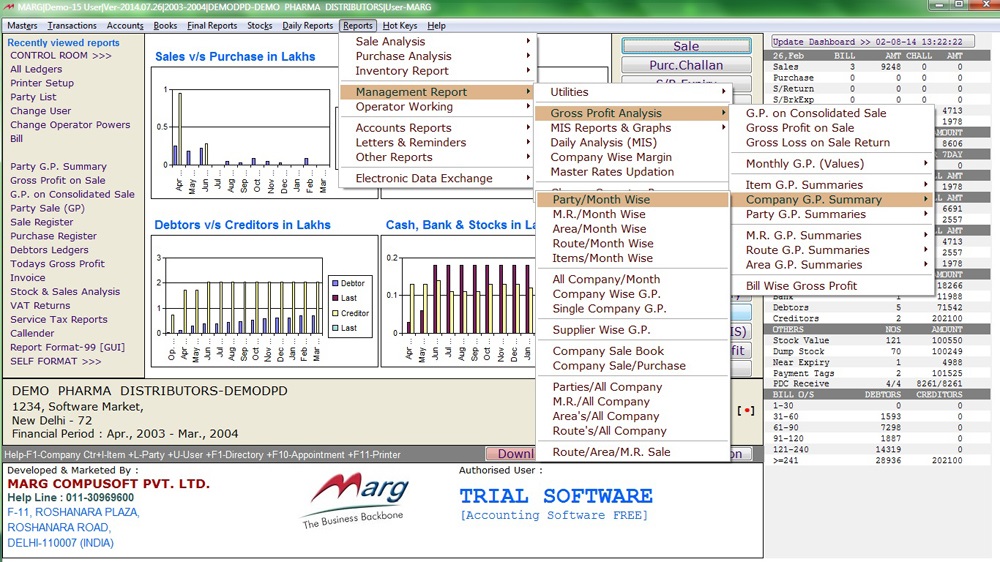

7. Marg ERP 9+

Core Features

- Distribution management

- Pharma industry compliance

- GST billing

- Inventory control

- Mobile app

Pricing Structure

- Basic: ₹18,000 (one-time)

- Professional: ₹36,000 (one-time)

Market Presence

Over 850,000 active licenses across India, with strong penetration in the pharmaceutical and FMCG sectors.

10 Factors to Consider When Choosing Accounting Software

Take the listed factors into account to find the best accounting software solution for the India unit of your small business.

-

Ease of use

Look for intuitive software that you and your team can learn fast and work efficiently with.

-

Features

Be sure that the software provides the particular features your company needs, like invoicing, expense tracking, and GST compliance.

-

Scalability

The system you choose must adapt and grow with you. As your business expands, it must allow more functions and handle more complexity.

-

Integration capabilities

Thoroughly assesses the possibility and appropriateness of the integration of the software with other tools such as CRMs or e-commerce platforms.

-

Mobile access

Presently, devices that can support your financial activities from anywhere are needed.

-

Support and training

Check the responsiveness of customer support and the availability of the training resources that will help you fulfill your learning and software demands better.

-

Pricing

To choose the most cost-effective solution, compare the options with regard to not only the immediate costs but also the long-term values they bring.

-

Security

Look for the security features that ensure your safety and the privacy of your financial data in the software.

-

Compliance

The software should be frequently checked and updated to keep up with the latest details on Indian tax laws and, thus, GST.

-

User reviews

Insider reviews can be the source on which you can rely to get some knowledge about the experience with the software.

The Impact of Online Accounting Software on Small Businesses

The implementation of the accounting software that is operating online can, in particular, have a substantial impact on the operations of small businesses in India. The following are some of the effects (better) of this:

-

Improved financial visibility

Analytics-based financial technology has created a future in which businesses can check cash flow in real time and thus make coherent decisions with full knowledge.

-

Enhanced productivity

The automatic shift of workload elements into the machine and, consequently, the giving of the employees free time can increase the efficiency of work, cut the costs for running the business, and provide the resources for redirecting.

-

Better compliance

Accounting software can help the firms with the process of their updates automatically and the regulations to which they need to conform by assisting them to both to comply with the tax laws that change and provide financial information.

-

Reduced errors

The use of software can do a more precise job than human beings in various activities like calculation and data entry; thus, the risk of making mistakes in financial records can be brought down substantially.

-

Cost savings

By means of clear financial management and the correct distribution of resources, firms can minimize their operational costs and thus use their resources effectively.

-

Scalability

As the company expands, the online accounting software has the capacity to hold increased complexity and volume.

Challenges and Solutions in Implementing Online Accounting Software

Online accounting software indeed has numerous benefits; nevertheless, there are also some on-ground issues that smaller businesses might encounter when implementing it. Here are some of the potential challenges and their respective solutions:

Challenge 1: Resistance to change

Solution: One way of solving this issue is to emphasize the profits of implementing the new system and training the employees in this manner.

Challenge 2: Data migration

Solution: The problem of data migration can be easily solved after you have made a good plan. Additionally, if needed, you can invite the help of a professional.

Challenge 3: Initial setup complexity

Solution: The system suppliers’ helpers will answer all your questions in time. You should take full advantage of this facility and use it when you first set up the program.

Challenge 4: Integration with existing systems

Solution: Choose software that has good integration capabilities combined with the use of APIs to establish links with your other current tools.

Challenge 5: Data security concerns

Solution: To lead to data protection practices, select software with the strongest security features and also explain how to use them to your team.

Future Trends in Online Accounting Software

Since technology is on the move, online accounting software may incorporate new features and services in the future.

- Artificial Intelligence (AI) and Machine Learning: Automation will become better with more advanced technologies.

- Blockchain integration: Blockchain technology could strengthen security and transparency in financial transactions.

- Increased mobile capabilities: There will be more features accessible from mobile devices.

- Enhanced data visualization: The new graphical tools will make data more accessible and clear with the reporting tools generated from financial reports.

- Greater integration with fintech services: These may allow for seamless connections with payment gateways, lending platforms, and other financial services.

Expert Recommendations

For Micro Enterprises (Annual turnover < ₹2 Cr)

- Recommended: Zoho Books or Clear

- Rationale: Cost-effective with essential features

For Small Enterprises (Annual turnover ₹2-50 Cr)

- Recommended: Tally Prime or QuickBooks Online

- Rationale: Scalable solutions with comprehensive features

For Growing Mid-sized Businesses

- Recommended: SAP Business One

- Rationale: Enterprise-grade capabilities with room for expansion

The Final Note

One of the chief decisions small businesses in India must make is selecting the correct online accounting software. Give serious thought to your requirements and preferences to decide on the best solution for you out of the many options listed in this article that you can use to simplify the management of your finances, stay compliant, and support your company’s growth.

Remember that the best software for your business may differ based on your demands, budget, and growth prospects. Avail of the free trials many software providers offer to run the demo before making a final choice.

When introducing online accounting software, you never close the doors to the learning process or the possibility of reengineering the procedures of your business in order to gain the maximum advantage of technology. You can run the company with the right tools and variants before the technology starts.

Ready to digitize your business accounting? Book a free consultation with me to find the perfect accounting solution for your business. Share your experiences with accounting software in the comments below.

Frequently Asked Questions

What is the minimum investment required for good accounting software?

Entry-level solutions start from ₹999 per month, while comprehensive solutions may require ₹18,000-36,000 as a one-time investment.

Can I switch between different accounting software?

Yes, most modern solutions offer data migration tools. However, careful planning is essential to ensure data integrity.

Is cloud-based accounting software secure?

Modern cloud accounting solutions employ bank-grade security protocols. According to NASSCOM, cloud accounting solutions have shown a 99.9% security success rate.